What is Double-Entry Bookkeeping in Accounting?

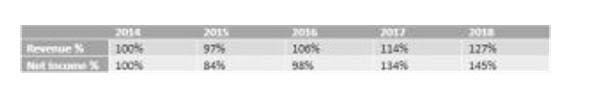

You can analyze the data and brainstorm strategies to control your costs. It helps you make decisions if you need to control your money or spend more towards the development of your business. How you choose to handle your finances will dictate the success of your business. Double-entry accounting can help make more informed business decisions that cater to its growth. Furthermore, investors look at your financial statements to see if your business is eligible for sponsors or huge investments. In double-entry accounting, you can clearly see the different expenses you use on your travel.

Common Transactions in Double-Entry Bookkeeping

Being able to see both sides of your financial transactions allows you to do a side-by-side comparison of credits against debits, helping to spot any discrepancies. The double-entry accounting method has many advantages over the single-entry accounting method. First and foremost is that it provides an organization with a complete startup bookkeeping understanding of its financial profile by noting how a transaction affects both credit and debit accounts. It also makes spotting errors easier, because if debits and credits do not match, then something is wrong. In single-entry accounting, when a business completes a transaction, it records that transaction in only one account.

a trial balance shows if the ledgers balance

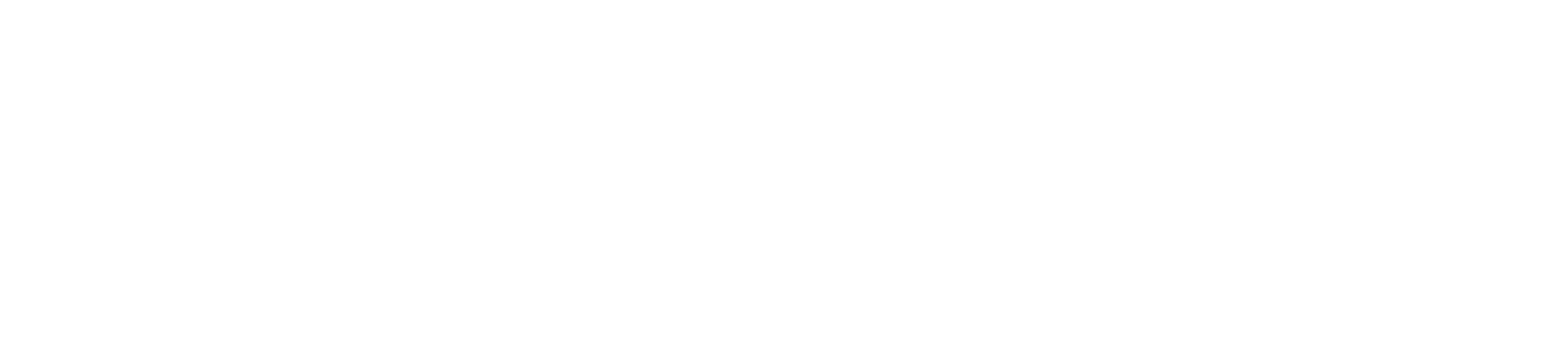

Posting transactions to the ledger involves transferring the debit and credit amounts from the journal to the corresponding accounts in the ledger. This process is typically done at regular intervals, such as daily, weekly, or monthly, depending on the volume of transactions and the needs of the business. In double-entry bookkeeping, every transaction affects two accounts, meaning two entries are made. Bookkeeping is the actual process of recording all of your business transactions. It doesn’t involve a lot of analytical work, in contrast to accounting, which focuses more on the in-depth financial evaluation of the business.

Double entry accounting FAQ

Good bookkeeping practices ensure that you have accurate records, which are essential for making informed decisions. For example, when you take out a business loan, you increase (credit) your liabilities account because you’ll need to pay your lender back in the future. You simultaneously increase (debit) your cash assets because you have more cash to spend in the present.

- Assign each expense to a specific category to monitor spending patterns.

- Gather all relevant tax forms, such as 1099s for independent contractors or W-2s for employees.

- Choose a bookkeeping method that works for you, whether it’s spreadsheets, cloud-based software, or a dedicated bookkeeping platform like doola.

- Using the Accounts Payable account in the above journal entry means that the invoice has not been paid with your bank funds.

Every time you pay for an expense in whatever month that the loan is allowed to offset, do the above steps until the loan is back down to 0.00. The aim here is to move the loan away gradually from the Balance Sheet liability to the Profit and Loss Report by offsetting the cost of relevant expenses as they occur. The aim here is to move the loan away for the full $3,000 from the balance sheet liability to Other Income on the Profit and Loss. The examples on this page are for both automatic journals involving the bank account and for manual entering of journals. If corrections must be made, this is the time to it and then a corrected trial balance produced. All accounts come under five main category headings which either go on the Balance Sheet (for example Asset Accounts) or the Income Statement (for example Expenses).

Double-entry bookkeeping and the software that helps

In fact, it will still be an asset long after the loan is paid off, but consider that its value will depreciate too as each year goes by. Credit The business now has a liability to repay the lender (the bank) the money on the due date in accordance with the loan agreement. The credit records this liability in the balance sheet under the heading loan. To receive a loan the business will post the following double entry bookkeeping journal entry. The amount is entered to the general ledger accounts using the debits and credits method.

- Even if you decide to hire an accountant to do the job, it’s still valuable to know the principles upon which accounting works.

- The balance sheet provides a snapshot of the assets, liabilities, and equity of the business at a specific point in time.

- It provides an accurate method for recording financial transactions.

- Don’t forget to take care of your personal credit card repayments on time.

- The owner’s equity is usually used by huge corporations to make decisions on dividend disbursements, company evaluations, and so on.

Double Entry Accounting Summary

When using the double entry accounting system, two things must always be balanced. The general ledger, which tracks debit and credit entries, must always be balanced. Additionally, the balance sheet, where assets minus liabilities equals equity, must also be balanced. The examples below will clarify the rules for double entry bookkeeping. Double-entry accounting is a bookkeeping system that requires two entries — one debit and one credit — for every transaction.